Cryptocurrency fans love to say, “It’s all about decentralization.” But when you start looking at transaction costs, speed, and actual utility, the picture isn’t so romantic. Steven Boccone has been following these markets long enough to know that not all blockchains are created equal and maintained properly, and sometimes the big crypto names are the biggest offenders when it comes to inefficiency.

It is very difficult watching inefficient, scandalous and poorly built tokens take the lead with stronger rallies, seemingly greater adoption and acceptance and higher market caps but in time that will be corrected. The best cryptos will eventually get their day in the sun and you can tell which ones those are just by using them. You need to kick the tires. Holding ETH and BTC makes sense but as you get educated you know better and do better by choosing competitors that make even more sense like XRP and FLARE.

Today, we’re lining up two head‑to‑head matchups: Flare vs. Ethereum, and XRP vs. Bitcoin. Fees, speed, utility, and even the awkward “who’s running the show” question are all on the table.

Flare vs. Ethereum: Cheaper Doesn’t Mean Lesser

Ethereum likes wearing its crown as the “king of smart contracts”, but it can also charge users like royalty. On average, Ethereum transaction fees can range from $.37 to $1000+. The higher end of that fee spectrum can be seen 20-25% of the time and mostly during major trading events which is when most people are trading and the stress levels are high. During these major rallies or liquidations ETH fees can rocket up to $1000 eating up all your profits and/or cutting deep into your investment (see Kevin O’Leary’s post on X below). ETH transactions take anywhere from 15 seconds to 30 minutes depending on network congestion and gas fees.

https://twitter.com/kevinolearytv/status/1978897749719265632

Flare, on the other hand, can push transactions through in about 1.8 seconds to a few minutes. The network uses FLR tokens to pay gas fees, and while exact USD values vary, these fees are tiny compared to Ethereum’s, likely just a few cents per transaction at most. That difference is not cosmetic, it directly affects operating costs and user adoption. It helps to know you will not be gouged by fees due to a congested network.

Estimating Volume Ranges by Congestion Levels (2022–2025)

Here’s a revised table that now includes approximate volume ranges, based on what we know about daily processing rates and typical behavior under different congestion scenarios:

| ETH Congestion Level | ETH Fee Range (USD) | Estimated Frequency (2022–2025) | Approx. Daily Tx Volume* | Context |

| Low | $0.30–$0.85 | ~25–30% | ~400k–500k tx/day | Quiet hours, off-peak traffic |

| Moderate | $3–$10 | ~50% | ~800k tx/day | Normal DeFi and app activity |

| High | $50–$1000+ | ~20–25% | ~300k–400k tx/day | NFT or DeFi surges, market events |

* Approximations. Based on a daily average of ~1.6 million Ethereum transactions (1.634M as of Sep 8, 2025)*

Gas Fees Comparison

(Based on September 4, 2025 appx. market prices of $4,400 ETH and $0.0201 FLR)

| Category | Ethereum (ETH) | Flare (FLR) |

| Low (quiet periods) | ~0.000085–0.00019 ETH ≈ $0.30–$0.85 | ~0.10 FLR ≈ $0.002 |

| Moderate | ~0.00068–0.0023 ETH ≈ $3–$10 | ~0.10 FLR ≈ $0.002 |

| High (congested) | ~0.0045–0.0227 ETH ≈ $50–$1000+ | ~0.10 FLR ≈ $0.002 |

Gas Fee Dynamics

- Ethereum: Gas prices fluctuate wildly with network congestion and transaction complexity. Although improvements have reduced fees, occasional spikes still happen.

- Flare: Fees are based on network activity, gas price, and gas limit. While variable, they remain very low under normal conditions. Even when tested during high liquidation events, as on 10/11/2025, the fees stayed low and did not surge like ETHs.

Legal and Regulatory Snapshots

- Ethereum: Its ecosystem is under regulatory scrutiny. Ongoing legal disputes challenge how the network and associated services are classified and regulated.Among the active legal battles:

- Consensys v. SEC: Consensys, the company behind MetaMask, filed a preemptive lawsuit arguing that Ether is not a security and MetaMask’s staking and swap services don’t violate federal law. This counters the SEC’s ongoing push to expand its jurisdiction over crypto services.

- SEC demand for transparency: The SEC issued subpoenas in early 2024 to companies tied to the Ethereum Foundation, reflecting a broader investigation into how Ethereum may or may not fit the definition of a security.

- Flare: The platform collaborates with regulators and law enforcement to address illicit activities. No major legal disputes are currently public.

Flare’s gas fees are not bid-based like Ethereum. Instead, they are:

- Set at a fixed baseline price:The network has a predefined gas cost for computational steps, which is then multiplied by a small fixed gas price (in FLR). This means the fee per transaction is stable, rather than market-driven.

- Extremely low in practice: On Flare Explorer, the average transaction consumes around 0.01–0.05 FLR in gas units, which at current FLR prices translates to fractions of a cent, roughly $0.001–$0.002 USD per transaction.

- Predictable because of design: Unlike Ethereum, where block space is scarce and users outbid each other during congestion, Flare uses a federated consensus mechanism (Avalanche + FBA) that doesn’t rely on miners competing for gas fees. As a result, even if the network gets busy, fees do not spike the way they do on Ethereum.

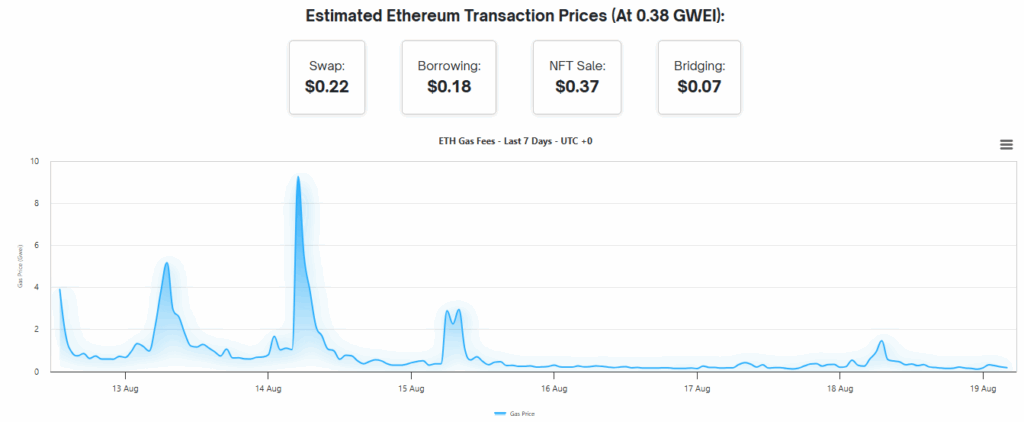

Ethereum’s fees are dynamic and can swing dramatically depending on network congestion. The chart above shows gas fees from the past week, with spikes reaching nearly 9 Gwei, translating into noticeable increases in transaction costs:

- Swaps: ~$0.22

- Borrowing: ~$0.18

- NFT Sales: ~$0.37

- Bridging: ~$0.07

While those numbers may look small at first glance, this snapshot is during relatively quiet periods. Historically, during peak congestion (NFT drops, DeFi liquidations, bull-run activity), fees have soared into tens or even hundreds of dollars per transaction.

Flare, by contrast, maintains stable fees around $0.001–$0.002 per transaction, regardless of demand. The network design avoids bidding wars for block space, so users never face fee shocks.

Ethereum Gas Fee Ranges and Historical Frequency (2022–2025)

| Congestion Level | Avg. Fee Range (USD) | Estimated Frequency (2022–2025) | Historical Context |

| Low | ~$0.30 – $0.85 | ~25–30% of the time | Off-peak hours, weekends, post-Dencun upgrade (2024–2025) brought temporary relief. |

| Moderate | ~$3 – $10 | ~50% of the time | Normal daily trading activity, DeFi usage, minor NFT drops. Most common fee environment in the last 3 years. |

| High | $50 – $1000+ | ~20–25% of the time | Seen during 2021–2022 bull run, major NFT launches (BAYC, Otherside), and DeFi liquidations. Still occurs today during heavy congestion spikes. |

Key Insights

- Low fees ($0.30–$0.85) are real, but they mostly happen during quiet periods (overnight hours or weekends).

- Moderate fees ($3–$10) have been the most common range across the last 2–3 years, making up about half of Ethereum’s transaction history.

- High fees ($50–$1000+) are less frequent but significant. They’ve repeatedly occurred in peak events over the last 2–3 years and remain a risk for users who transact without timing the market.

Flare by contrast has stayed at a near-flat $0.001–$0.002 per transaction with no historical spikes, highlighting its predictable cost advantage.

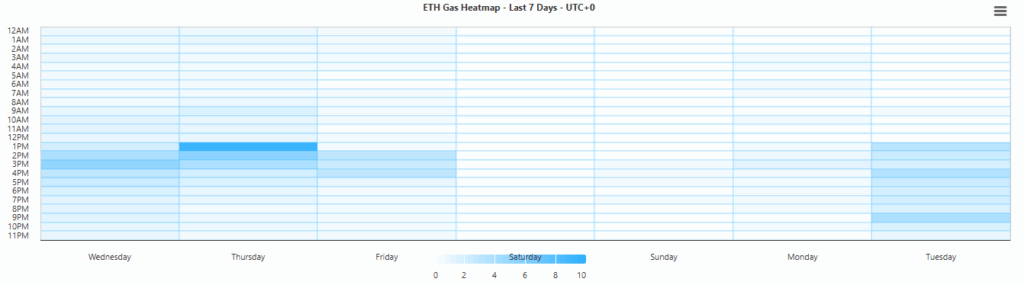

When You Pay More: Ethereum’s Congestion Heatmap vs Flare’s Stability

The heatmap above tracks Ethereum gas fees over the past 7 days. Darker blocks show periods when gas prices surged due to heavy network activity. Notice how:

- Midweek afternoons and evenings (UTC time) see the heaviest spikes.

- Weekends and late nights are generally calmer, though not guaranteed.

- Traders and developers often wait for “cheaper” windows, but this is unpredictable.

This variability means that a transaction could cost cents at midnight and several dollars or more in the afternoon.

Flare’s model avoids this entirely.

- Its gas fee is fixed and consistent, around $0.001–$0.002 USD per transaction, regardless of day, time, or demand.

- Businesses can transact without worrying about “waiting for low-fee hours.”

Key Features

| Feature | Flare | Ethereum |

| Average Fee | ~$0.01 (estimated) | ~$0.85 (or ~$0.37 if using L2) |

| Average Speed | 1.8 seconds | 13 seconds to several minutes |

| Consensus Mechanism | Avalanche + Federated Byzantine Agreement | Proof of Stake |

| Interoperability | Built for cross-chain compatibility | Primarily Ethereum ecosystem |

| Ecosystem Size | Smaller, emerging | Largest in DeFi and NFTs |

How They Work

- Ethereum uses a Proof of Stake setup where validators stake ETH. Transactions are bundled into blocks, and users often pay higher gas during congestion.

- Flare employs a hybrid of Avalanche and Federated Byzantine Agreement. It is designed for fast finality, low fees, and seamless cross-chain integration.

Investment Considerations

- Cost Efficiency: Minimal fees on Flare can significantly improve net returns for frequent users of the network.

- Ecosystem Risk: Ethereum’s robust developer and user base delivers trust and opportunity. Flare’s smaller ecosystem carries potential growth, but adoption risk remains.

- Regulatory Environment: Ethereum’s regulatory future is uncertain with ongoing disputes in the U.S. Flare, while regulator-friendly, may still face scrutiny as it grows.

XRP vs. Bitcoin: The Speed Demon vs. The Grandfather

Bitcoin gets the lion’s share of attention in the crypto space, but that fame comes with inefficiencies. Average transaction costs sit around $1.21, and confirmation times average roughly 13.3 minutes. For something introduced as “peer-to-peer cash,” this performance is far from instant.

XRP operates in a different league for transaction speed and cost. It can settle in 3 to 5 seconds and charges only $0.0002 per transaction on average, sometimes up to $0.0011. You could complete hundreds of XRP transactions for less than the cost of one Bitcoin transaction.

And then there is the founder question. XRP has Ripple Labs, a known entity with a clear leadership structure. Bitcoin’s founder is a mystery. That is fine for decentralization purists, but it also means no one is accountable when things go wrong which is something MOST people are not accustomed to.

Transaction Fees and Legal Landscape

| Category | Bitcoin | XRP |

| Avg. Transaction Fee | ~$1.21 | ~$0.0002 (up to $0.0011) |

| Speed | ~13.3 minutes | 3–5 seconds |

| Fee Trends | Can spike significantly during congestion | Stable, consistently low |

| Legal / Regulatory Issues | Not classified as a security; potential for regulatory monitoring over mining energy use | Faced SEC lawsuit alleging unregistered securities sale; partial court rulings favor Ripple |

Fee Dynamics

- Bitcoin: Fees are driven by network congestion and block size limits. During periods of high demand, fees can surge to several dollars per transaction.

- XRP: Uses a fixed-fee model designed to prevent spam on the network. Fees are burned, meaning they are permanently removed from the supply.

Legal Snapshot

- Bitcoin: Generally treated as a commodity in the U.S., but its energy-intensive mining process attracts regulatory scrutiny.

- XRP: Ripple Labs was in a long legal battle with the U.S. SEC but on August 8th, 2025 the SEC dropped its case against Ripple and XRP.

Key Features

| Feature | Bitcoin | XRP |

| Primary Use | Store of value, limited payments | Payments, cross-border transfers |

| Speed | ~13.3 minutes | 3–5 seconds |

| Fees | ~$1.21 average | ~$0.0002 average |

| Consensus | Proof of Work | XRP Ledger Consensus Protocol |

| Governance | Decentralized, anonymous founder | Ripple Labs leadership |

How They Work

- Bitcoin uses Proof of Work, requiring miners to solve cryptographic puzzles to validate blocks. This process is secure but slow, and expensive in terms of energy.

- XRP runs on the XRP Ledger Consensus Protocol, where trusted validators agree on transactions in seconds without mining. This makes it more energy-efficient and faster for payment processing.

Investment Considerations

- Transaction Efficiency

XRP offers significantly faster and cheaper transactions than Bitcoin, which can be crucial for payment-focused applications. - Market Position

Bitcoin’s dominance and brand recognition give it unmatched liquidity and trust, even if it is less efficient for transactions. - Regulatory Risk

Bitcoin’s regulatory exposure is mostly environmental, while XRP’s has centered on securities law, which has seen partial resolution.

Source: Google Finance, August 14, 2025

Steven Boccone’s Take

“The hype is easy to buy into, but numbers do not lie. If you are paying triple in fees for the same result, you are not being loyal to the network, you are being loyal to losing money,” Boccone says.

When you strip away branding and fan loyalty, the reality is straightforward:

- Flare delivers a cheaper, faster and better structured way to execute smart contracts than Ethereum.

- XRP outperforms Bitcoin in speed and transaction costs.

- Ethereum’s vast ecosystem currently remains unmatched, but it comes with higher fees and potential legal uncertainties.

- Bitcoin continues to hold the market cap crown, but it is far from the most efficient network for payments or transactions.

In Boccone’s view, crypto is not about choosing the “cool” chain. It is about understanding exactly what you are paying for and deciding whether the value you receive justifies the cost.

Leave a Reply